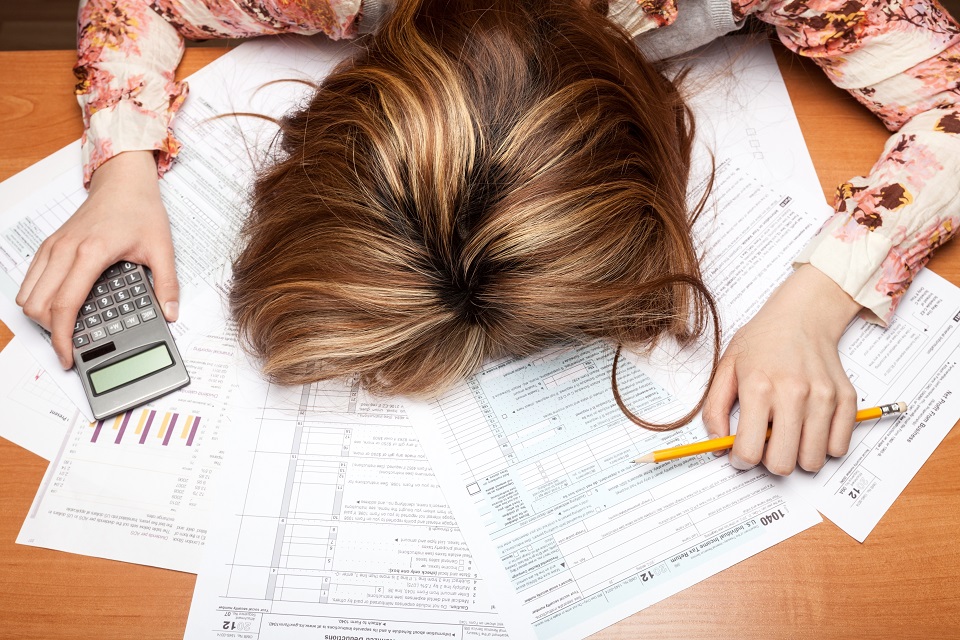

As April 15 approaches, taxpayers are preparing for the most stressful time of the year: the tax filing season. The U.S. tax code is really complicated and even though its rules are complex, most of the mistakes taxpayers make on their returns are quite simple.

People tend to make a lot of mistakes because they just want to get rid of this tough period as soon as possible. From filing late to not filing at all, these tax mistakes can be avoided if you stay informed. Read on to discover what to do in these situations.

1. Filing late

Not filing on time means bad news. The Internal Revenue Service (IRS) estimates 20 percent of taxpayers wait until a week before the deadline to file their income tax returns. Unfortunately, waiting until the last minute isn’t a good idea. You could miss the deadline if you run into any problems while completing your forms.

It’s true, an extension could give you more time to file your returns, but you still have to pay any taxes owed by the original deadline which is April 15, 2020 for tax year 2019. If you aren’t able to make the payments by the due date, the IRS will charge you interest and no one wants that.