3. Those who itemize their deductions

Another thing that aroused curiosity was Biden’s idea of capping the value of itemized deductions at 28 percent. The entire plan is to minimize the total amount of itemized deductions for those who pay a marginal tax rate above 28 percent.

This actually applies to those who fall right now in the 32 percent, 35 percent, and 37 percent tax brackets (or, of course, the proposed bracket, namely 39.6 percent). So, if Biden wins, wealthy people will get a 28 percent tax reduction for every dollar spent on charity, not 39.6 percent.

If we take into consideration the current 32 percent tax bracket for single taxpayers who have a taxable income less than $163,301 and the taxable income that applies to joint filers with $326,601, we can strongly affirm that Biden’s idea of limiting the amount of itemized deductions to 28 percent could translate to higher taxes for those who earn less than $400,000.

However, up until now, there’s no clarity on this subject, but it could be a good idea to increase charitable donations this year.

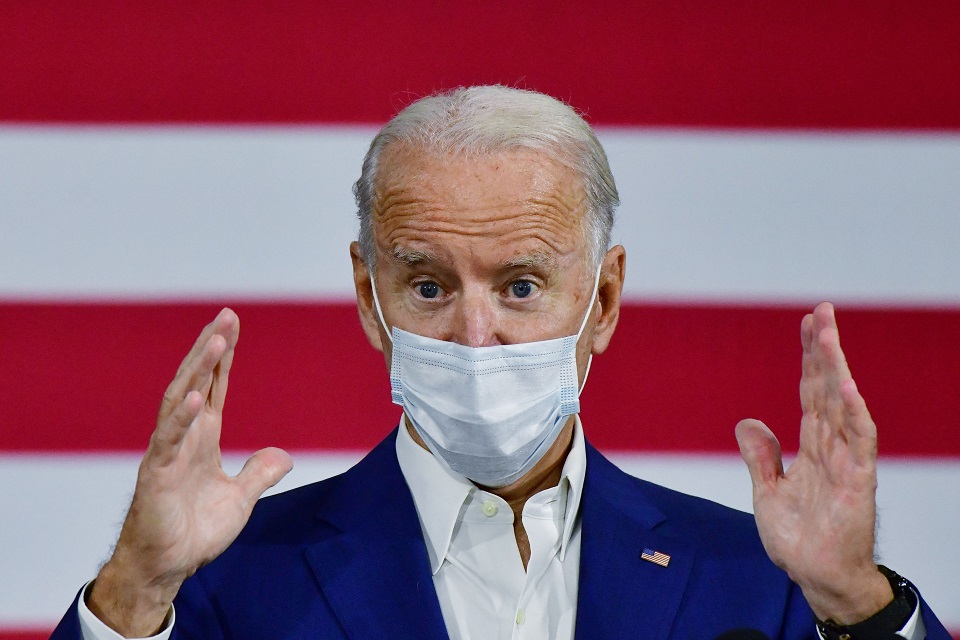

4 thoughts on ““Will Joe Biden Raise My Taxes?” Let’s Find Out!”

About time. But it willbe passed on to the commkn people anyway. Items will skyrocket in price

Who should we trust Biden or Trump? Common man…do you trust Trump with anything?

Joe also said he will do away with the Trump tax cuts, all of them.

If Biden wins, he will probably forget what he promised after the election. He is a politician with dementia. That’s what they do.