How to Use Your Tax Refunds for a Better Life

In 2017, the average U.S. tax refund surpassed $3,000. While most people don’t see it as unexpected income, this sum

8 Legal Benefits Every U.S. Retiree Should Know Of

Every U.S. retiree must be aware of certain benefits. Whether it’s coupons, theatre tickets or other domains, you can get

What the New Tax Law Means for Small Businesses/Freelancers

Ever since the changes in tax law hit the news last December, U.S. residents have been trying to get as

7 Easy Tricks That Lower Your 2018 Tax Bill

As you probably already know, there are many things you can do ahead of the tax season to save extra

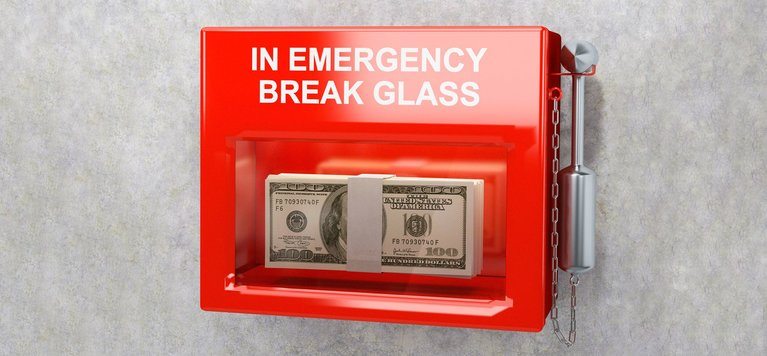

How to Build an Emergency Fund That’s Actually Useful

Yes, I know that any emergency fund is good at some point. What few people know, though, is that they

10 U.S. States That Tax Your Social Security Benefits (and How)

Are Social Security benefits really taxable? Well, yes and no; it all depends on the state you live in. Vermont,

9 Things Few People Know Are Actually Taxable

Everybody is well accustomed to the kinds of taxes they are prone to. Wages are taxable, investment incomes are taxable,

7 Tax Breaks Every Middle-Class American Should Know

One of the most common misconceptions about tax breaks is that only certain companies or fund managers can get them.

Social Security Retirement Age Officially Increases in 2018

Statistically speaking, most baby boomers are able to claim their Social Security benefit once they turn 66. However, U.S. citizens