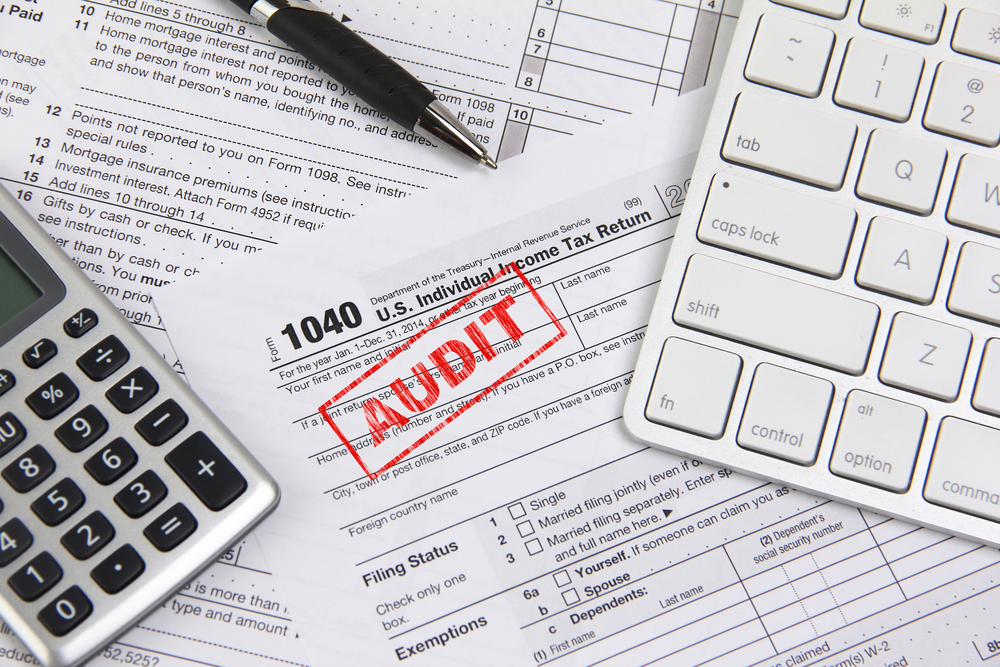

The IRS can sometimes make your life very problematic, you can make even a small error and they will be at your door.

An audit is a time consuming and stressful situation for you, and the IRS usually does it in order to make sure you are obeying the law and don’t have any hidden assets. When it comes to the IRS there is no joke and no ,,omissions” are accepted.

In case you are unfamiliar with the ways the Internal Revenue Service can question you or your business we have listed a few things you should pay attention to so that you won’t have any issues.