Arizona — rising

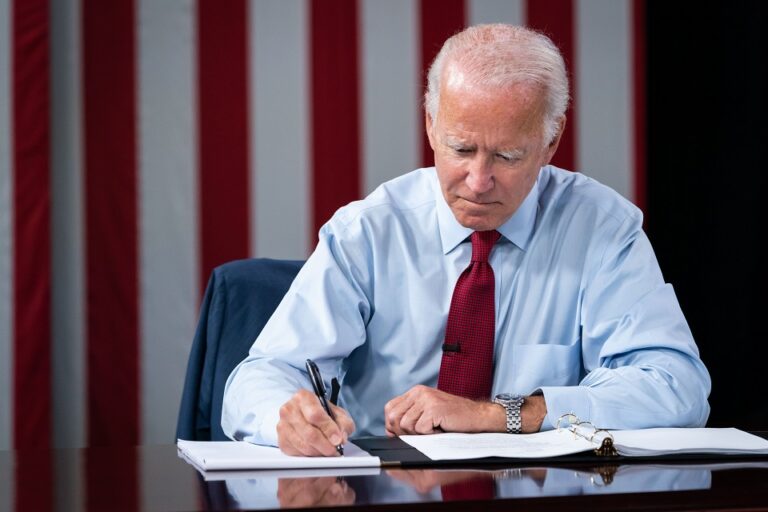

It was shocking for the entire nation when we found out that Arizona has voted for the new president, Joe Biden, instead of Donald J. Trump. In other words, Arizona residents choose to raise their taxes alone.

However, did they it with a specific purpose: to help fund education. Arizona voters agreed with Proposition 208. Therefore an income tax surcharge is needed in order to fund education. What’s more… a new income tax bracket has been included in Arizona’s tax code. The tax bracket has a rate of 8 percent, and when we think about the former rate (4.5 percent), the difference is huge.

New Mexico — rising

Another state that’s rising the income tax bracket is New Mexico. Right now, the maximum rate is 5.9 percent. Yes, 1 percent higher than the old one (4.9 percent). This happened because the state was unable to reach its revenue growth target last year.

So, since everything has consequences, New Mexico taxpayers will have to pay it.

However, if you live in Colorado or Utah, two of the four states that border with New Mexico, you are lucky. Colorado and Utah’s income taxes will not see an increase, but in Colorado, you will still face higher vaping taxes. Don’t you think it’s about time to quit smoking?

Also of interest:

- How to Reduce Your Taxes in Retirement

- These 9 States With No Income Tax Have Other Hidden Taxes

- Why Should You File Your Taxes Early? Here Are 5 Money-saving Reasons!