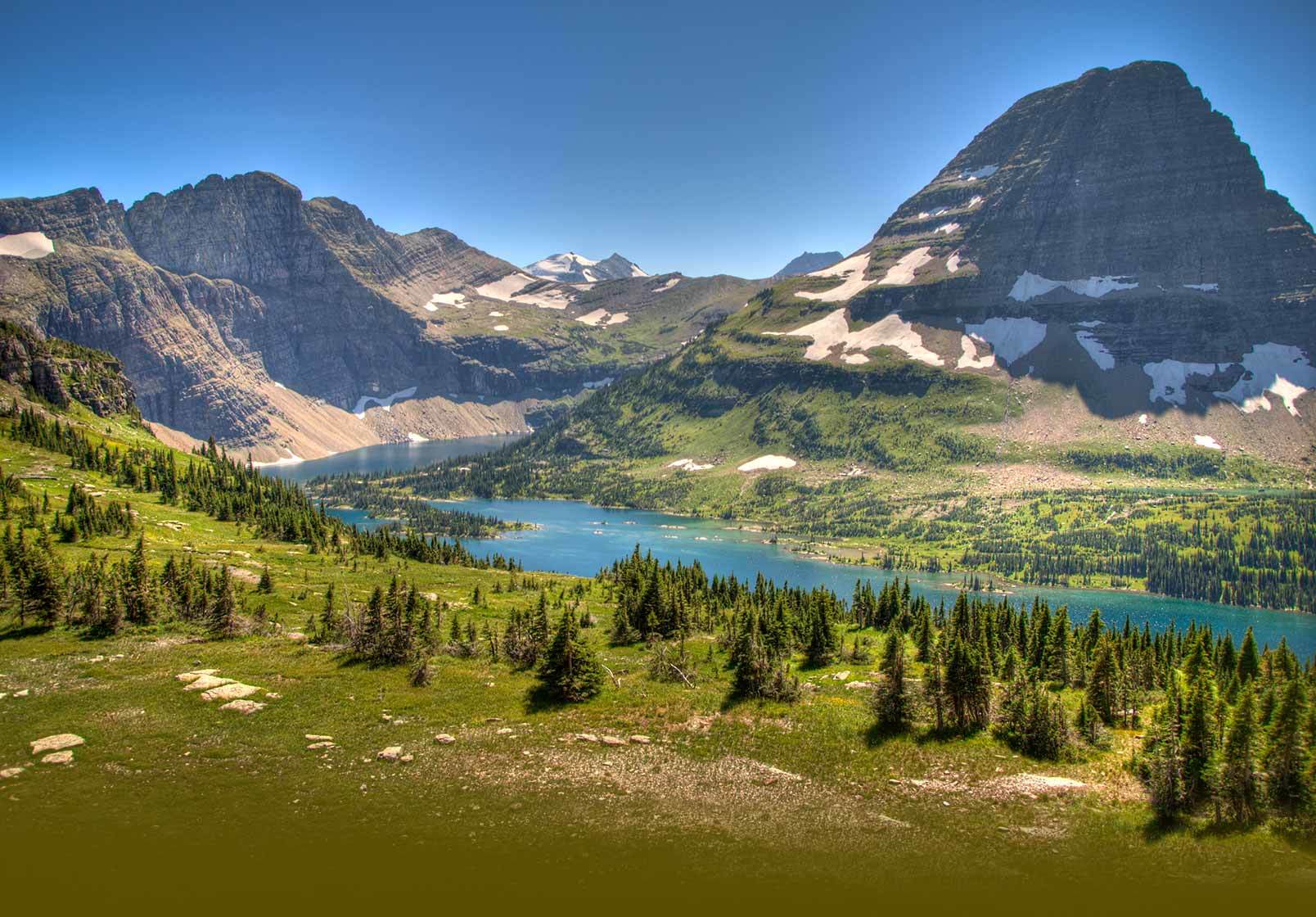

Montana

Our ranking: Tax-friendly

State income tax: 1% (on up to $3,000 of taxable income) — 6.9% (on taxable income over $17,900).

Average state and local sales taxes: None

Gas taxes and fees: 32 cents per gallon

The Treasure State is one of five states that do not impose a general sales tax (though you’ll find one in some resort areas). That, along with relatively low property taxes, is the good news. The bad news is that the top income rate of 6.9% kicks in at just $17,900 of taxable income. Montana is one of a handful of states that allows residents to deduct some of their federal income taxes from their state return.

Pages: Page 1, Page 2, Page 3, Page 4, Page 5, Page 6, Page 7, Page 8, Page 9, Page 10, Page 11, Page 12, Page 13, Page 14, Page 15, Page 16, Page 17, Page 18, Page 19, Page 20, Page 21, Page 22, Page 23, Page 24, Page 25, Page 26, Page 27, Page 28, Page 29, Page 30, Page 31, Page 32, Page 33, Page 34, Page 35, Page 36, Page 37, Page 38, Page 39, Page 40, Page 41, Page 42, Page 43, Page 44, Page 45, Page 46, Page 47, Page 48, Page 49, Page 50, Page 51