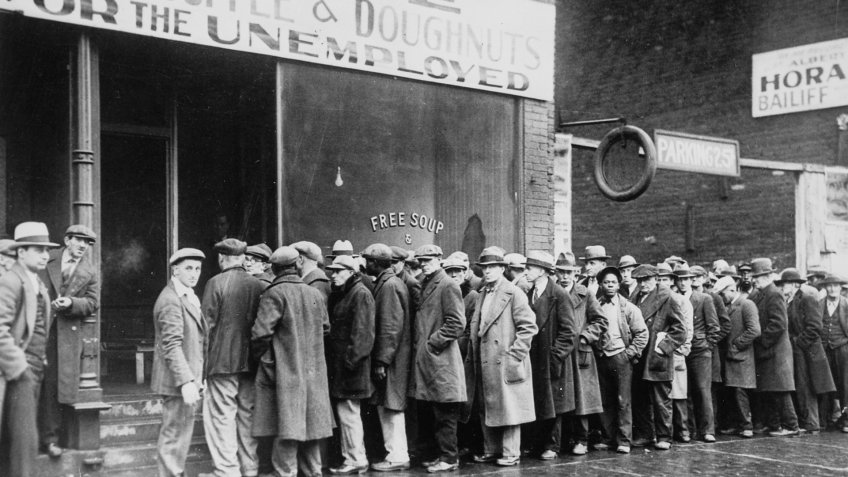

1930s

The stock market crash of 1929 brought the Roaring Twenties to an abrupt, violent end. The Great Depression prompted a vigorous debate over the role of the federal government, one that President Franklin Delano Roosevelt would eventually win. The New Deal meant enormous levels of government spending focused on stimulating the economy and getting Americans back to work.

2 thoughts on “Then and Now: The Top Tax Rates Over the Last Century”

Property taxes are illegal, because the property owner has to carry the expenses of the more numerous none property owners. Taxes should apply equally to all Americans.

It does. Cecelia, don’t you imagine that the property owners, by way of their financial advisors,are accounting for property taxes in the rents charged to their tenants? That would include commercial property, certainly. It simply makes sense to pass some of that on, since it’s a cost of doing business. Being a renter doesn’t indicate a lack of intelligence. I’m sure it’s also something your restrauranteur, jewelry store, furniture store, or other favorite place, consider when first deciding on pricing for goods and services.