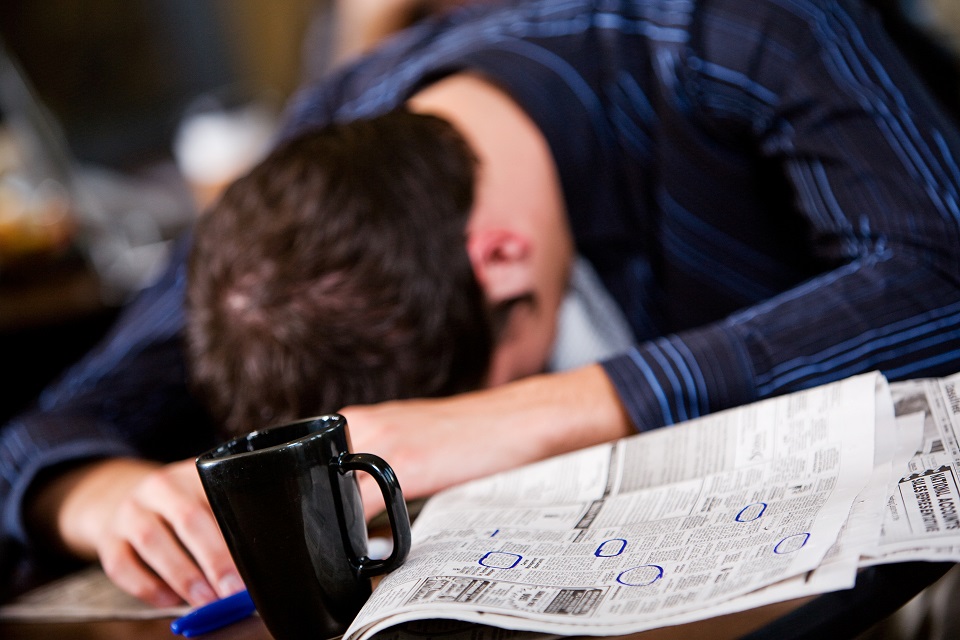

5. Job-hunting costs

While college students can’t deduct the costs of hunting for that new dream job, already-employed workers can. The costs that are associated with looking for a new job in your current occupation, including fees for resume preparation and employment of outplacement agencies, are deductible as long as you itemize.

Unfortunately, there’s a pitfall here: These costs, along with other itemized expenses, must exceed 2 percent of your AGI before they produce any tax savings. However, the phone calls, employment agency fees and other expenses might be just enough to get you over that income threshold.