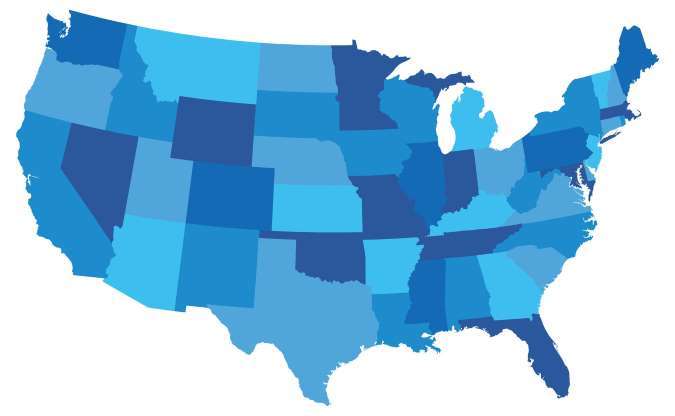

The 10 states with the highest property taxes

Annual homeowner tax bills across the U.S. range from an average of $684 in Alabama to $8,485 in New Jersey, according to an analysis from the National Association of Home Builders (NAHB). As mentioned previously, property taxes are based on a percentage of a home’s value, multiplied by the local tax rate, which can explain the wide variation in tax bills.

Take a look at the 10 worst states for property taxes. We’ve highlighted the NAHB’s data on the average amount of taxes paid each year in these states, as well as the average effective property tax rate, which can be expressed either as a percentage of a home’s value or a dollar amount charged for every $1,000 of a home’s value.

We’ve also included the median home values in each state, according to data from the U.S. Census Bureau.

4 thoughts on “10 States With the Largest Property Tax Bills”

Big surprise, the top ten are all Democratic strongholds, I live in Oregon and pay $6800 per year, yes another Democrat state. As an aside we do not have sales tax and we cannot pump our own gas. DB

Lived there all my 84 years of life and all the Dems have done is to raise, raise and raise taxes until they strangle you and you have to move out to survive. That’s what all these Democratic run states do.

General trend: 1) More socialized the economy (take from ‘Peter’ give to ‘Paul’), the larger the property tax with not relation to home value, 2) The bluer the state, politically, the higher the tax rate, 3) numbers of people fleeing living in a state may correlate to the tax rate.

Interesting study if possible: How have the top ten states grown economically over the past 30 years relative to other states as a function of tax rates .

Be it Democrat or Republican when you have lived all of your life paying taxes there should be a reduction or a end of older tax payers who are now living on a fixed income. Cook County Illinois is horrible. You go for an appeal you are either rejected or your taxes are higher on the next payment. I am trying to find somewhere to move right now