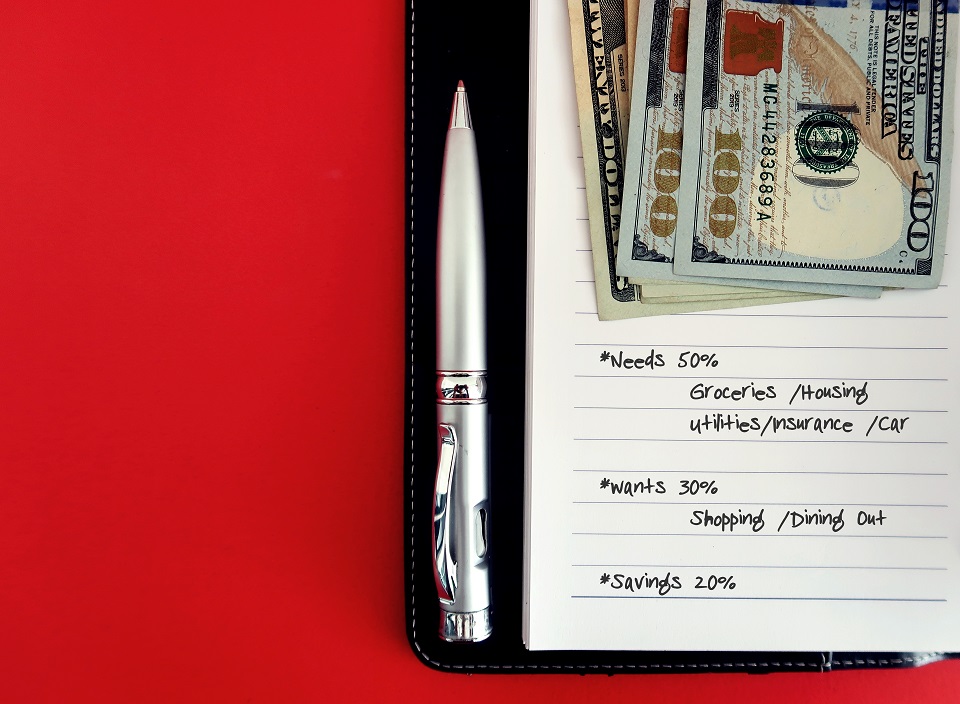

2. Take advantage of the 50/20/30 rule

The 50/20/30 rule is probably the best way to budget, especially when referring to an irregular income. Lynn Toomey, co-founder of Your Retirement Advisor, suggests following this easy budgeting rule:

- Use 50 percent of your income for non-discretionary necessities like food, rent/house payment, utilities, and transportation.

- Put aside 20 percent of your income for an emergency fund (three to six months’ salary is a good target), retirement, savings, and to pay off any debts.

- Use 30 percent of your income for discretionary (non-essential) spending such as entertainment, vacation, and gifts.