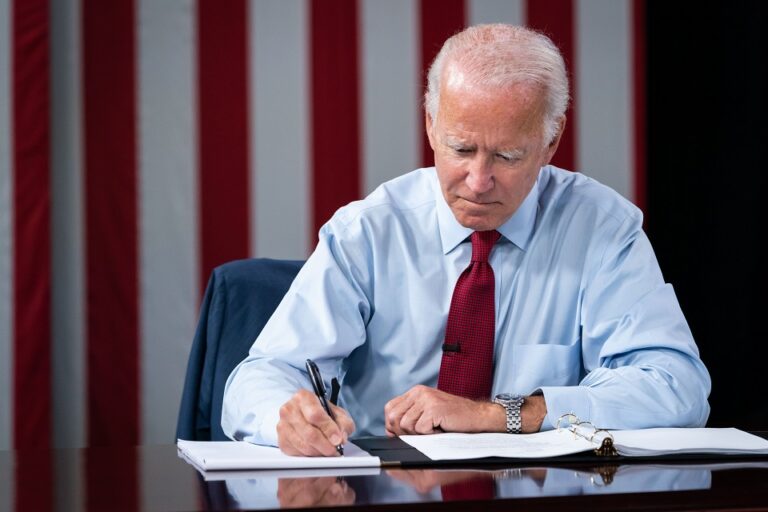

9 States That Will Give Extra Stimulus Checks in 2022

This year started out pretty bad and it's not getting any better. The federal government has stated that it will no

Busted! Stop Believing These 7 Social Security Myths

Social Security benefits are most likely a part of your plan when it comes to retirement. It pays almost $100

13 Laws That Make America a Better Place

We all want a better country to live in! And usually the "friend in need" is the law. They are the

Most Commented POSTS

News

Trials & Lawyers

Useful Laws

Finance Tips